IRS Whistleblower’s Notes Contradict FBI Agent About Weiss Meeting on Hunter Biden Case

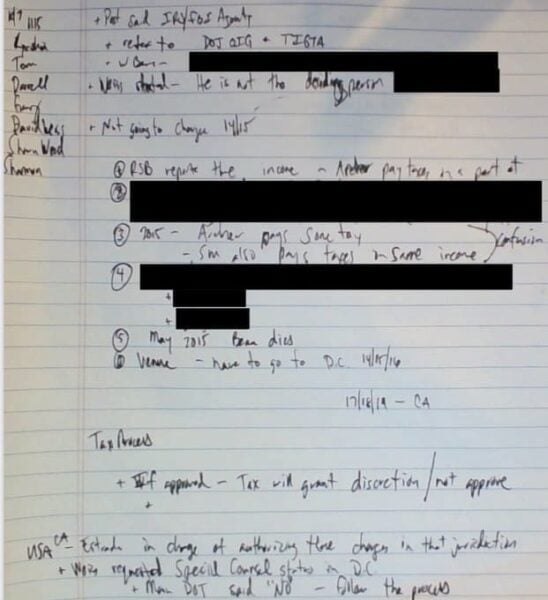

Attorneys for IRS whistleblower Gary Shapley released on Wednesday contemporaneous handwritten notes taken by Shapely at a key October 7, 2022 meeting with U.S. Attorney for Delaware David Weiss in the Hunter Biden investigation that confirms his testimony and contradicts that of an FBI agent assigned to the case, Thomas Sobocinski. (Images of Shapely’s notes posted by the House Judiciary Committee are at the end of this article.)

The notes also cast doubts on statements by Weiss about his status and independence. Weiss was appointed Special Counsel in the Hunter Biden investigation last month by Attorney General Merrick Garland after both men had professed that Weiss already had the powers of a special counsel.

Soborcinski’s closed door testimony given last week to House lawmakers was leaked to the Washington Post on Tuesday in an effort to discredit Shapley’s testimony that Weiss had said he was not the decider on whether to charge Hunter Biden on tax violations. Attendees at the Hunter Biden investigation status meeting included IRS investigators including Shapley, FBI agents and DOJ attorneys.

Gary Shapely, file screen image.

Shapley’s notes said: “Weiss stated – He is not the deciding person. Not going to charge 14/15.” And, “Weiss requested Special Counsel status in DC + Main DOJ said “NO” follow the process.”

The notes detail Weiss saying he would have to seek permission to file tax charges against Hunter Biden for the years 2017, 2018 and 2019 in California and years 2014, 2015 and 2016 in Washington, D.C., but would not bring charges for the years 2014 and 2015.

The Post reported Soborcinski’s testimony (excerpt):

Key parts of Sobocinski’s interview with lawmakers focused on an Oct. 7, 2022, meeting that Gary Shapley, one of the IRS whistleblowers, had earlier described to the lawmakers.

Shapley said Weiss told FBI and IRS agents during that meeting that Weiss was not the “deciding official on whether charges are filed.” But Sobocinski, who was also there, said he did not hear Weiss say that and “never felt that [Weiss] needed approval” to bring charges.

Sobocinski, who is the special agent in charge of the FBI’s Baltimore field office, noted there was “bureaucratic administrative process” Weiss had to work through to bring charges outside Delaware but that his understanding was “that [Weiss] had the authority to bring whatever he needed to do.”

“I never thought that anybody was there above David Weiss to say no,” he said.

Pressed again on the issue later in the interview, he said, “I went into that meeting believing he had the authority, and I have left that meeting believing he had the authority to bring charges.”

…Sobocinski said he had no awareness of several other claims Shapley made about the Oct. 7 meeting, including that Weiss informed the group that U.S. District Attorney for D.C. Matthew Graves would not allow Weiss to charge Hunter Biden with tax violations in the nation’s capital.

But he added that he while he had a “very high-level sense of IRS charges,” he was not tracking the “minutia” of tax law nor the statute of limitations that was set to lapse on Hunter Biden’s 2014 and 2015 tax returns. Sobocinski also said that he did not take any notes during the Oct. 7 meeting or send emails about it afterward. Shapley, in contrast, memorialized his takeaways from the meeting in notes and an email later that day.

Excerpt from Just the News report on Shapley’s notes:

An IRS whistleblower’s contemporaneous notes of his October 2022 meeting with Delaware U.S. Attorney David Weiss quotes the prosecutor as saying he was “not the deciding person” on charging Hunter Biden with tax crimes, according to documents transmitted by his lawyer to Congress on Thursday,

IRS Supervisory Agent Gary Shapley’s handwritten notes, obtained by Just the News, call into question both Weiss’ representation to Congress as well as other witness testimony released in recent days, according to the letter to House Ways and Means Committee Chairman Jason Smith from Tristan Leavitt, the president of the Empower Oversight whistleblower center and a lawyer representing Shapley.

The notes attached to the letter clearly state Weiss told agents that he had tried to be appointed a special counsel unsuccessfully and was not going to bring criminal charges against Hunter Biden for failing to pay taxes on 2014-15 income, including hundreds of thousands of dollars he had received in compensation from Burisma Holdings in Ukraine.

🚨 #BREAKING: IRS Supervisory Agent Gary Shapley's handwritten notes of his October 2022 meeting with Delaware U.S. Attorney David Weiss quotes Weiss saying he was “not the deciding person” on charging Hunter Biden with tax crimes.

Weiss has changed his story multiple times. pic.twitter.com/Pz17lnjQyU

— House Judiciary GOP 🇺🇸 (@JudiciaryGOP) September 13, 2023

Earlier statement by Shapley’s attorneys on the October 7, 2022 meeting, “Statement from IRS Agent Gary Shapley’s legal team: “In an October 7, 2022, meeting at the Delaware U.S. Attorney’s Office, U.S. Attorney David Weiss told six witnesses he did not have authority to charge in other districts and had thus requested special counsel status. Those six witnesses include Baltimore FBI Special Agent in Charge Tom Sobocinski and Assistant Special Agent in Charge Ryeshia Holley, IRS Assistant Special Agent in Charge Gary Shapley and Special Agent in Charge Darrell Waldon, who also independently and contemporaneously corroborated Mr. Shapley’s account in an email, now public as Exhibit 10, following p. 148 of his testimony transcript. Mr. Shapley would have no insight into why Mr. Weiss’s would make these statements at the October 7, 2022 meeting if they were false. That Mr. Weiss made these statements is easily corroborated, and it is up to him and the Justice Department to reconcile the evidence of his October 7, 2022 statements with contrary statements by Mr. Weiss and the Attorney General to Congress.”

Statement from IRS Agent Gary Shapley's legal team: “In an October 7, 2022, meeting at the Delaware U.S. Attorney's Office, U.S. Attorney David Weiss told six witnesses he did not have authority to charge in other districts and had thus requested special counsel status. Those six… pic.twitter.com/hMKhCQfDo6

— Empower Oversight (@EMPOWR_us) June 23, 2023

You can email Kristinn Taylor here, and read more of Kristinn Taylor’s articles here.