Joe Biden Reminisces About Bouncing Checks (VIDEO)

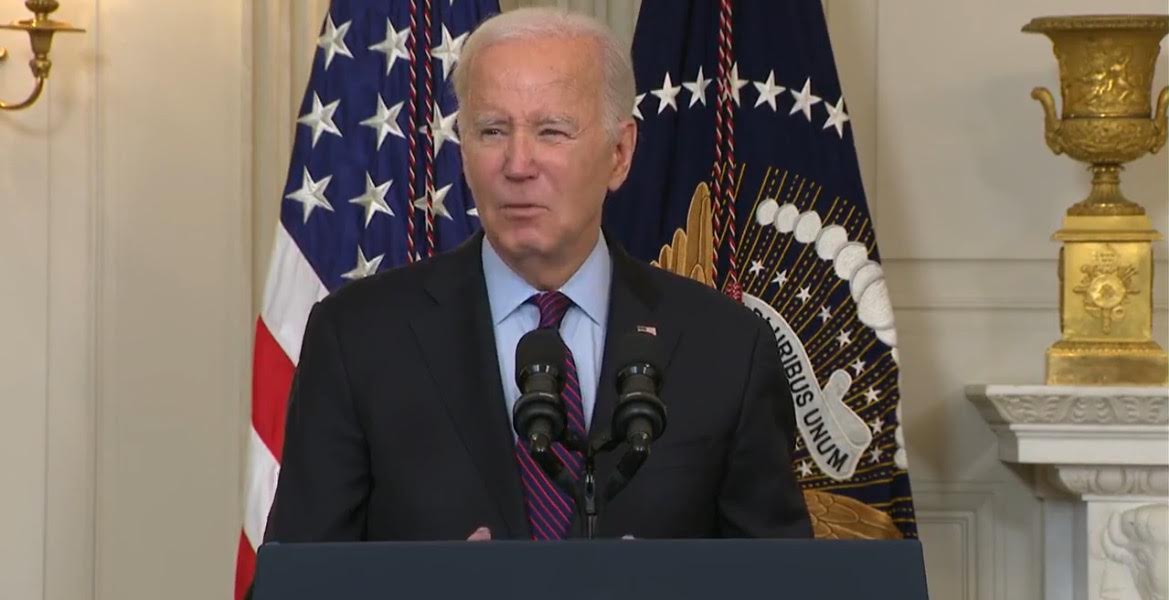

Joe Biden on Tuesday delivered remarks on retirement security.

“I ran for president to make sure the economy works for everyone!” Biden said from the State Dining Room.

Biden’s economic agenda dubbed ‘Bidenomics’ has been proven to be a total failure.

At one point Joe Biden reminisced about bouncing checks when he was “trying to get started” – before he started his international influence-peddling operation with his son Hunter and brother James.

“When you’ve bounced a few checks like I did, you know, when I was trying to get started, it, uh, anyway…” Biden said.

WATCH:

Biden sure has come a long way from the days he bounced checks.

It was recently revealed Joe Biden purchased his luxury $2.75 million Rehoboth Beach, Delaware home with all cash after Hunter Biden threatened his Chinese business partner in a $5 million shakedown.

On August 8, 2017, $5 million was wired from a CEFC-affiliated investment vehicle (Northern International) to the bank account for Hudson West III, which spent the next year transferring $4,790,375 million directly to Hunter Biden’s firm, Owasco, according to a Senate report reviewed by this reporter.

A few weeks before this desperate shakedown, Joe Biden plopped down nearly $2.75 million in cash for his Rehoboth Beach home. No wonder why he was so desperate to get this cash from Hunter’s business partner. He was counting on it to cover his new real estate transaction.

“Property records show Joe’s six-bedroom second property was purchased on June 8, 2017 for $2,744,001 – just seven weeks before his son’s shakedown messages.” The Daily Mail reported.

There was no record of a mortgage lien against the Rehoboth property until Joe and Jill Biden opened a $250,000 HELOC (home equity line of credit) against the property last December.

How did Biden go from bouncing checks to paying cash for a $3 million beach front vacation home after 50 years of government salary?

Excerpt from White House on Biden’s new announcement on his so-called actions to protect retirement security:

The proposed rule builds on the Biden-Harris Administration’s efforts to eliminate junk fees, putting cash back in the pockets of Americans. The Federal Trade Commission proposed a rule that would ban businesses from charging hidden and misleading fees and require them to show the full price up front and a “click-to-cancel” rule making it as easy to sign up for a service as to cancel it. The Consumer Financial Protection Bureau took action to require large banks and credit unions to provide basic information to consumers without charging fees. The Department of Transportation has proposed several new rules that would lead to more transparent pricing by airlines and reimburse customers when there are significant changes to their flight.

Today’s announcement also builds on important actions the Biden-Harris Administration has taken to protect the retirement of hardworking Americans. In December 2022, President Biden signed SECURE 2.0 into law, which encourages more employers to offer retirement plan benefits to their workers and makes it easier for Americans to save. Additionally, as part of the American Rescue Plan, President Biden signed the Butch-Lewis Emergency Pension Plan Relief Act, which protects the pensions of 2 to 3 million workers.

You can email Cristina Laila here, and read more of Cristina Laila’s articles here.