In a recent post shared on X, the social media platform previously known as Twitter, environmental lawyer and 2024 presidential candidate Robert F. Kennedy Jr. claimed 30-year fixed mortgages are now over 8%.

30-year fixed mortgages now over 8%. No one can afford to buy now. Rents shooting up too. Time to implement my plan of tax-free, government-backed 3% mortgage bonds to make homeownership accessible again. #Kennedy24

— Robert F. Kennedy Jr (@RobertKennedyJr) September 29, 2023

Verdict: Unsubstantiated

While some firms and areas have mortgage rates of 8% or higher, the national average remains at 7.30%. Rates are the highest since 2000, when mortgage rates were last over 8%, with some experts suggesting rates could stop just shy or barely meet the level.

Fact Check:

The U.S. housing market will likely be affected by the end of a freeze on federal student loan payments, according to Fox Business. According to a recent Pulsenomics poll, economists believe that resuming student loan payments will impact homeownership rates for at least a year, the outlet reported.

Kennedy made the claim about rising mortgages in a Sep. 29 X post. He wrote in part, “30-year fixed mortgages now over 8%. No one can afford to buy now. Rents [sic] shooting up too.”

The claim, though, is complicated by the available data. In August 2023, Axios reported that U.S. mortgage rates were moving toward 8% due to slumping home sales and pressure on broader market rates. Referencing data from Mortgage News Daily, the outlet indicated that the average 30-year fixed mortgage rate hit 7.49%. The Federal Reserve’s efforts to combat inflation and yields on the U.S. 10-year Treasury bond both appeared to be factors influencing mortgage rates, according to the outlet.

Data cited in a Sept. 8 Investopedia article also examined recent trends in 30-year mortgage rates, placing the average for 30-year fixed-rate new purchase loans at 7.33% on Aug. 10, 7.80% on Aug. 22, and 7.48% on Aug. 30. The same data shows mortgage rates have spiked again recently, with the reported average for 30-year fixed-rate new purchase loans being 7.84% on Sept. 7. The same article listed national averages of lenders’ best rates for refinancing as 8.26%.

A Sept. 29 article from Investopedia shows 30-year fixed mortgage rates continued to increase throughout the month, with the rate at 7.92% on Sept. 21 and 8.10% on Sept. 28. This same article showed the national averages of lenders’ best rates for refinancing also spiked to 8.46%.

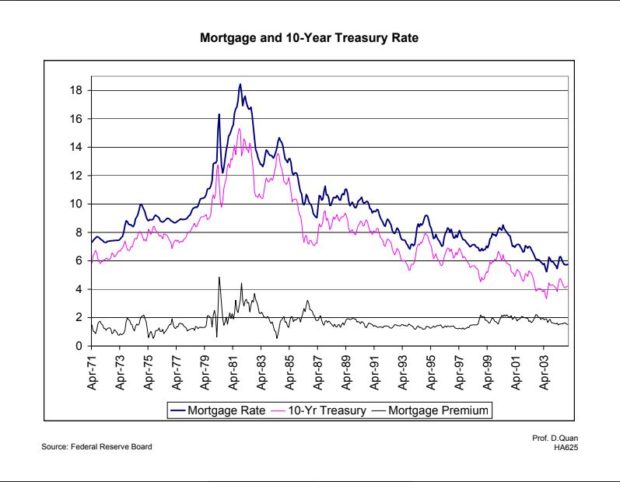

Conversely, mortgage rate data available via Freddie Mac shows the average 30-year fixed mortgage rate as 7.31% as of Sept. 28. The same data appears on the St. Louis Fed’s website. This data looks at the average 30-year fixed mortgage rate from April 1971 to present. According to the data, the last time the 30-year fixed mortgage rate approached nearly 8% was in August 1999 at 7.80%. (RELATED: Did Wells Fargo Impose A $1,000 Daily Cash Withdrawal Limit?)

Additionally, back in August, CNN reported that mortgage rates had reached their highest level in 21 years since the 30-year fixed mortgage rate hit 7.13% in April 2002. In discussing rising mortgage rates, the outlet noted that the average mortgage rate is based on the applications lenders submit to Freddie Mac and includes only those who “put 20% down and have excellent credit.”

In reviewing the housing market and 30-year fixed mortgage rates, researchers are already looking ahead to 2024. According to an August 2023 Fortune article, researchers from top firms such as Morningstar, Goldman Sachs, and Morgan Stanley predict average mortgage rates in 2024 will be 5.0%, 5.9%, and 6.0%, respectively. Lowering mortgage rates as well as increasing incomes and decreasing home prices will impact overall housing affordability, the outlet indicated.

Dr. Daniel Quan, a real estate professor at Cornell University, said historically, 8% is not that high when it comes to mortgage rates.

“Historically, 8% is not that high and the suggestions that housing is no longer affordable is not true,” Quan told Check Your Fact via email. “In the inflationary 80s, mortgage rates were in the order of 18%-19%,” he added.

Daniel C. Quan/Federal Reserve Board/Screenshot

Keith Munsell, a Master Lecturer of Strategy and Innovation at Boston University, disagreed, suggesting that the probability of firms charging 8% for a 30-year mortgage rate was low.

“On Thursday, September 28, 2023, Freddie Mac stated that the 30-year home mortgage rate had risen to an average of 7.19%. Though some firms may be attempted to charge 8% that is a highly unlikely scenario,” Munsell stated.

Check Your Fact also contacted the U.S. Department of Housing and Urban Development (HUD), who declined to comment, directing us to the Mortgage Bankers Association instead.

Check Your Fact has contacted the Mortgage Bankers Association, Freddie Mac, multiple mortgage and housing market experts, and Kennedy’s campaign spokesperson for comment. We will update this piece accordingly if one is received.